AMD’s mega chip deal has caused a major competition with Intel on 5G network infrastructure and with Nvidia on SmartNICs. With the latest $35bn deal with Xilinx, AMD on Tuesday strengthened its claim to being one of the long-term winners in supplying chips for data centres, where much of the computing power required for cloud computing and machine learning is concentrated. This decision comes as the semiconductor industry starts to consolidate its resources to target the upcoming wave in artificial intelligence, data center and cloud computing platforms – the latter two of which have seen their demand go up during the pandemic as corporations start to invest in remote working platforms and populations all over the globe start to increasingly rely on home-based entertainment platforms.

AMDs fall and rise from near bankruptcy

Since Chief Executive Lisa Su took over AMD in 2014, she has focused on challenging Intel in the fast-growing business of data centers that power internet-based applications and services and are fuelling the rise of artificial intelligence and fifth-generation telecommunications networks.

From Graphics cards powering the latest games today, to CPUs using the latest architecture, AMD’s portfolio uses some of the best hardware available on the market today. But that hasn’t always been the case. But that hasn’t always been the case. In the early 2000s, and in 2010, AMD had lost a lot of market share, and it’s profits plummeted.

Through most of 2011 and 12, AMD laid off around 25% of its workforce to stay alive. Acquiring ATI technologies and SeaMicro barely helped them in any way.

Finally, in 2013, AMD’s stock devalued over 60%. That same year, AMD staged a sale and lease-back deal for their Austin Texas campus, in order to free up $164 million in cash. It wasn’t sufficient, but it was enough.

Lisa Su was appointed president and CEO on 8th October 2014, replacing Rory Read. Once she became the head of the company, she wasted no time in getting it restructured into two different business groups. The first group was the consumer electronics group focused on consumer graphics, VR and workstation graphics. The second group was enterprise, embedded, and semi-custom, i.e., servers, system-on-a-chip products, gaming consoles, engineering, cloud gaming, medical imaging devices, networking, and embedded CPUs.

After the launch of Zen CPUs in 2017, AMDs market share shot up to 11% and the growth has been continuing until this day while rivalling both Intel and Nvidia, and even making inroads into the server market. By the first quarter of 2019, AMD has regained close to 30% of the CPU market share. Similarly, AMD secured over 30% of the GPU market by the second quarter of 2019.

A stock only deal

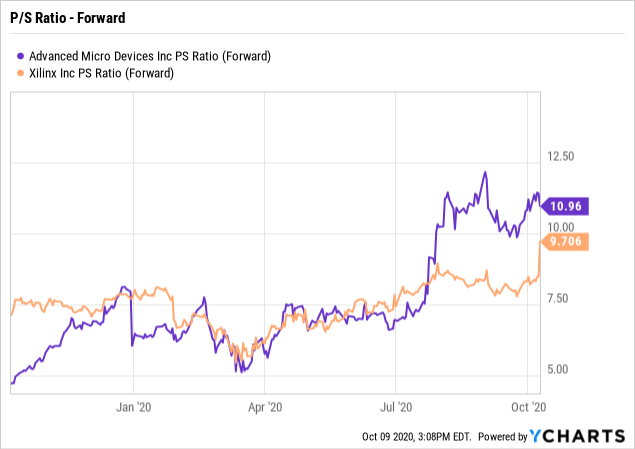

There were rumours surfacing the web earlier that AMD was in advanced talks to purchase Xilinx for $35 billion. The rumours are now confirmed, and AMD announced that it offered Xilinx shareholders $35 billion in an all stock deal. There wasn’t any cash used here. AMD’s skyrocketing stock is what’s used as a currency in this deal. AMD’s shares are over 70% this year which values the company at $92 billion in market cap right now. It’s up 25% since the announcement. For every one share Xilinx shareholders own, they will receive 1.7234 shares of AMD. Based on the exchange ratio at the time of the announcement, that pegs Xilinx shares at $143, or a market cap of $35 billion – some 25% higher than just prior to the announcement.

AMD’s war on Intel in the data center

AMD has long been Intel’s chief rival for central processor units (CPUs) in the personal computer business. Since Chief Executive Lisa Su took over AMD in 2014, she has focused on challenging Intel in the fast-growing business of data centers that power internet-based applications and services and are fuelling the rise of artificial intelligence and fifth-generation telecommunications networks.

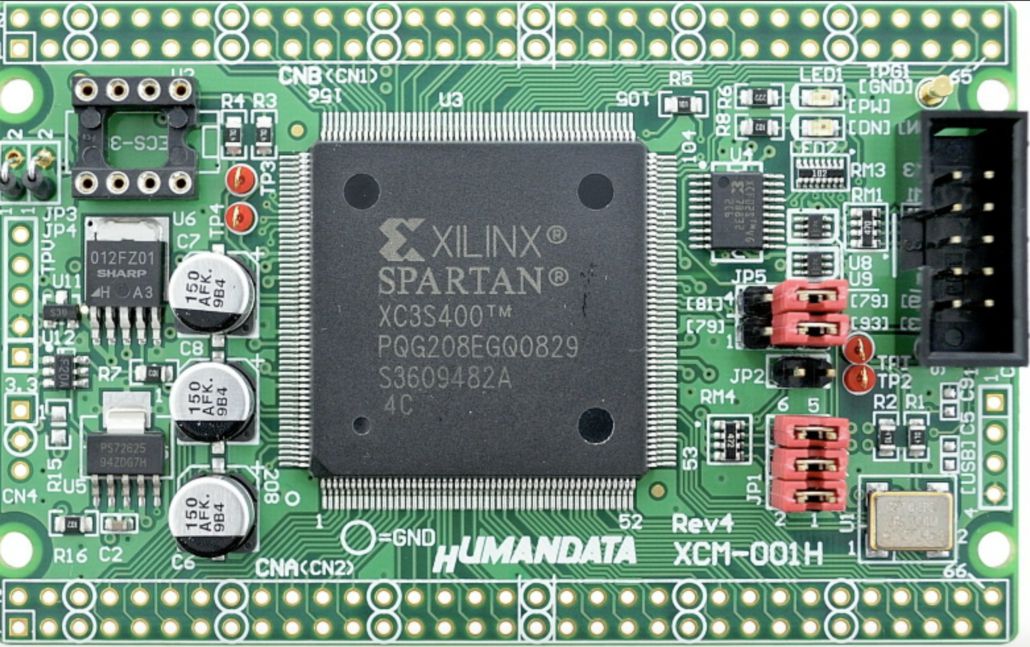

Xilinx’s biggest rival was Altera, which was scooped by Intel several years ago for its technology and portfolio of FPGA (field programmable gate array) chips. In June 2015, Intel bought Altera for $16.7 billion, an approximate 56% premium at the time. It was Intel’s biggest ever deal.Xilinx will bring AMD more expertise in markets such as 5G communications, data center, automotive, industrial aerospace and defense.

“Xilinx is the ideal match for AMD,” AMD Chief Executive Lisa Su said on a conference call.

“We will have a combined TAM [total available market] of $110 billion, building on AMD’s $80 billion TAM with an additional $30 billion, a very attractive Xilinx TAM,” Su told analysts. “As we look at growth drivers in the three-to-five-year time frame, we see significant revenue synergy opportunities that can build on AMD’s strong organic growth.”

In the short term, the main benefit from the deal will come from diversification. This will help AMD extend it’s reach into 5G base stations and also the automotive market where Xilinx gets majority of its sales. This eagerness to diversify has been one of the main forces driving the dealmaking that transformed the chip industry over the past 5 years.