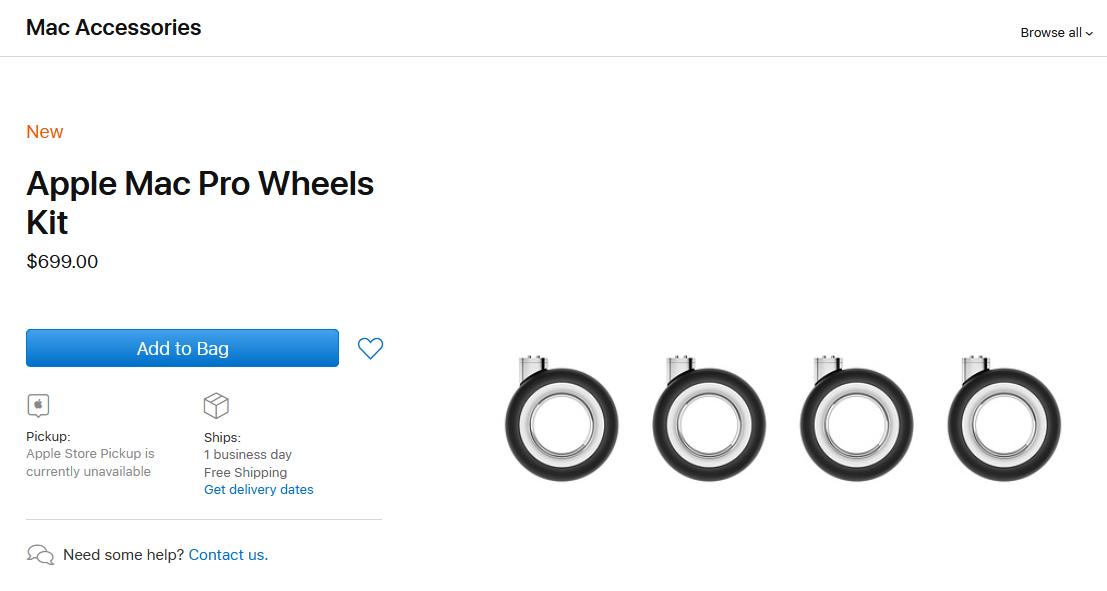

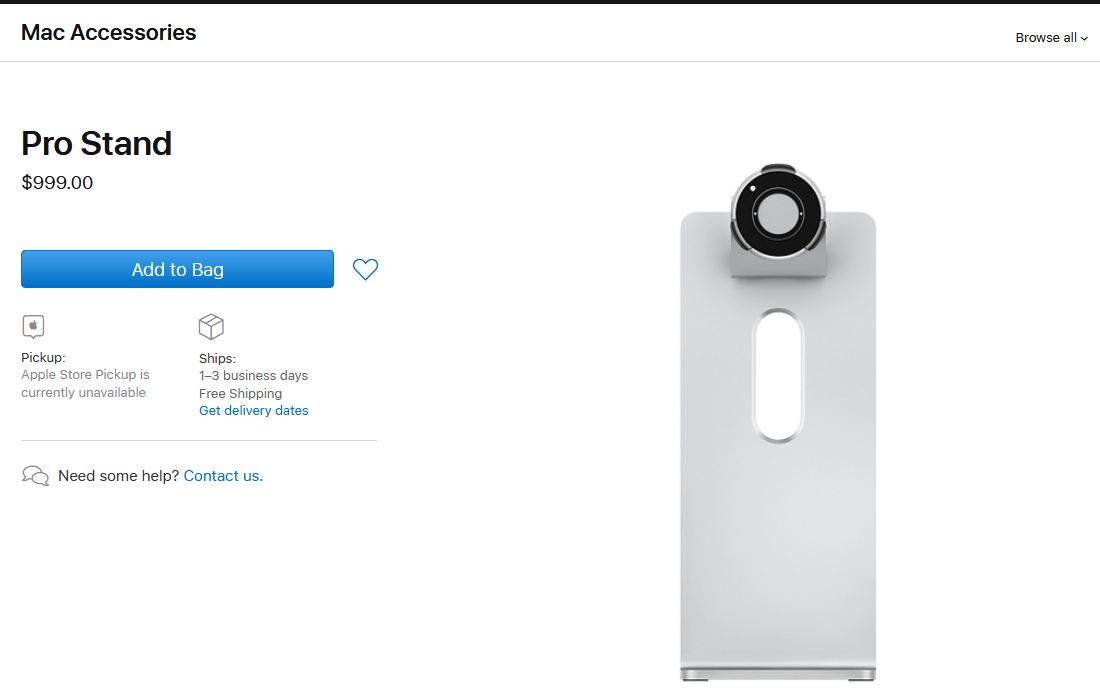

At first we at Tekhdecoded thought Apple was selling gaming wheels. We took a closer look, and were taken aback! It’s wheels for dragging your Mac Pro around. $700 just for a set of wheels. That’s almost as crazy as toilet paper flying off the shelves these days. Is it April 1st? or did it pass by 20 days ago? Sounds ridiculous doesn’t it? Not just that, you also get a monitor stand for *only* a grand.

In case that’s not enough, you can spend a little more on the monitor stand.

Did Apple reinvent the wheel/roller? Apple recommends the wheels as “ideal for moving your Mac Pro quickly and easily without having to lift it”.

Apple also stated that you can…

“Put your Mac Pro on wheels with the Mac Pro Wheels Kit. The custom-designed stainless steel and rubber wheels make it easy to move your Mac Pro around, whether sliding it out from under your desk or across your studio,”

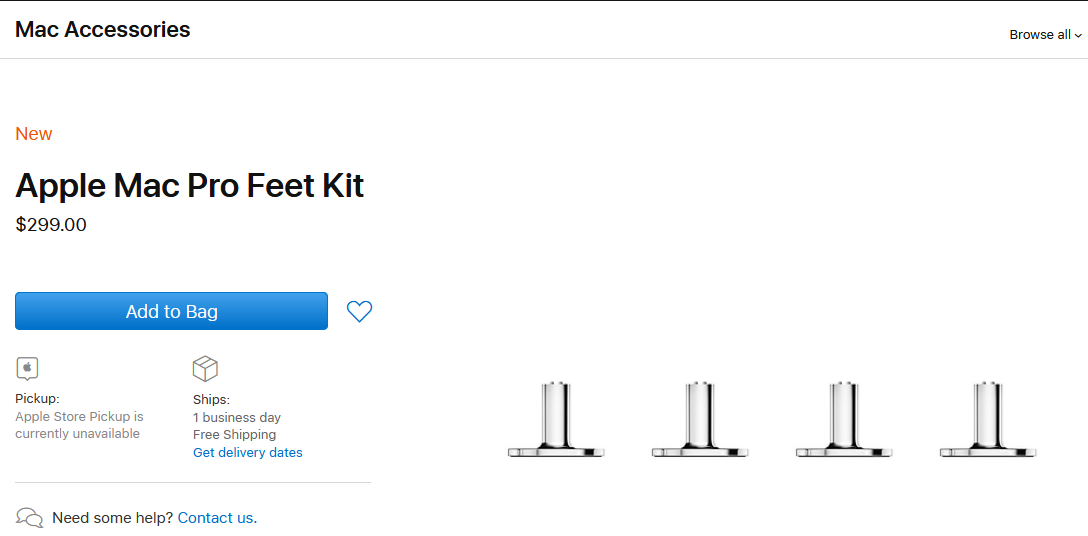

In case the wheels are, and I quote “too expensive”, or if you maybe don’t prefer dragging your Mac Pro desktop across the room, you could always switch to Mac Pro Feet for almost half the price. It’s as simple as picking cotton!

While the feet are just 300 bucks, and comes by default with the Mac pro, you can upgrade them to the wheels for $400 extra. At least Apple includes a 1/4-inch to 4mm hex bit, but the listing notes that additional tools are necessary if you’re going to fix them yourself.

We wonder though, if they are user serviceable when they clog up with cat fur, fluff and pizza crumbs. I suppose that’s not the case. The funny thing about the wheels is, they have no brakes/stopper, and your

You know, you could always get casters for 1/10th the cost on the market. Unless you’re rolling in money, this is perfectly suitable for you.

Mac Pro rack

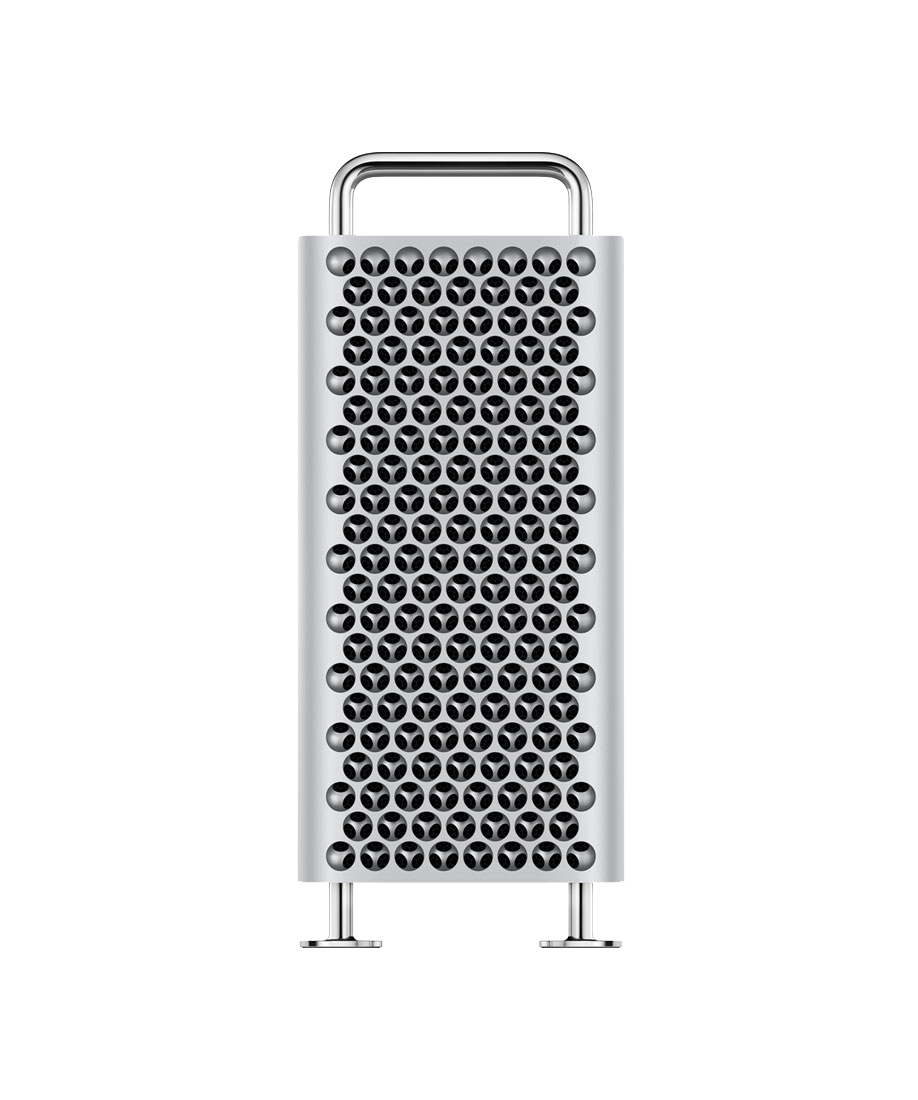

When ordering a Mac Pro, the case alone starts at $6500, and your configuration can go all the way up to $50k.

Sometimes we wonder if this “cheese grater” as everyone claims, is worth the buck!

We decided to find out what could be a suitable alternative for Apple’s “magic wheels” as they claim.

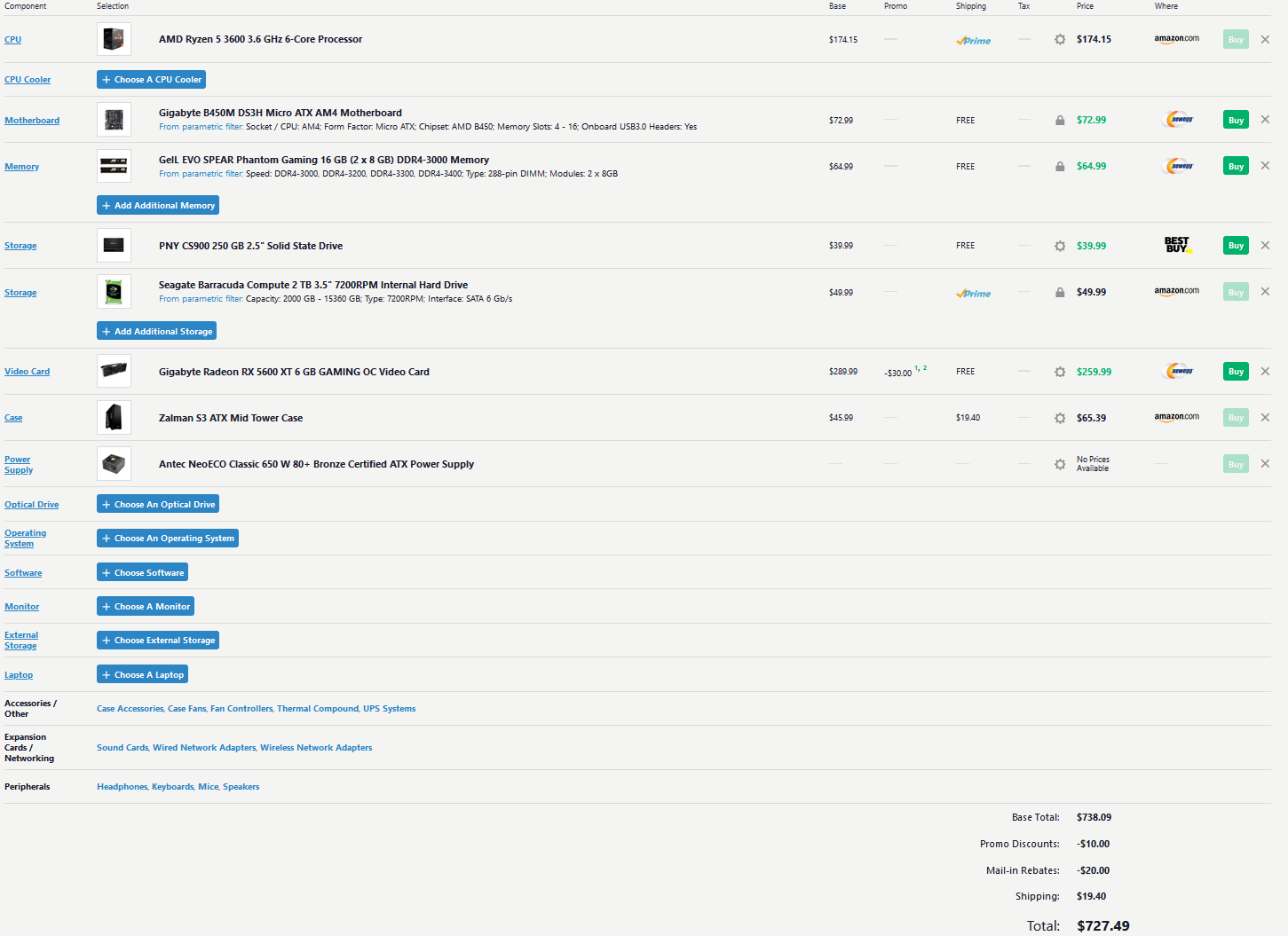

We did a PC parts list, and for almost $30 extra, you could get a nice sweet rig, minus the mouse, keyboard, and monitor. Fortunately, neither of these desktops come with wheels though.

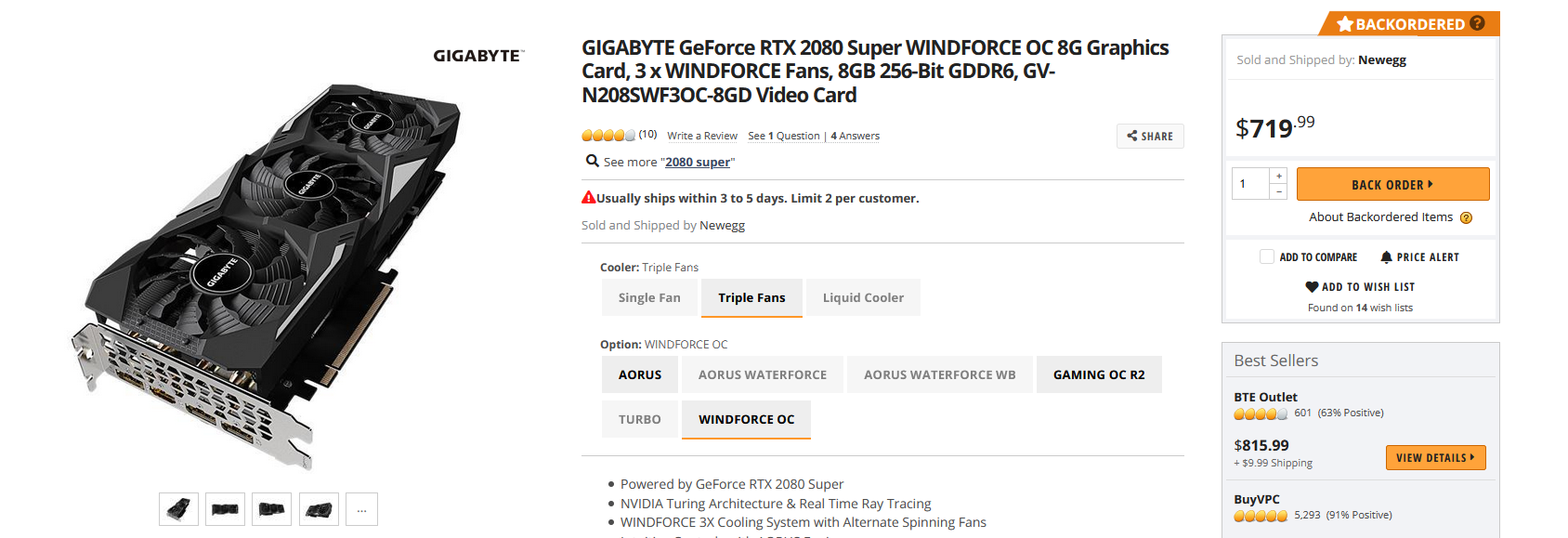

You could grab a 2080 super for $20 extra

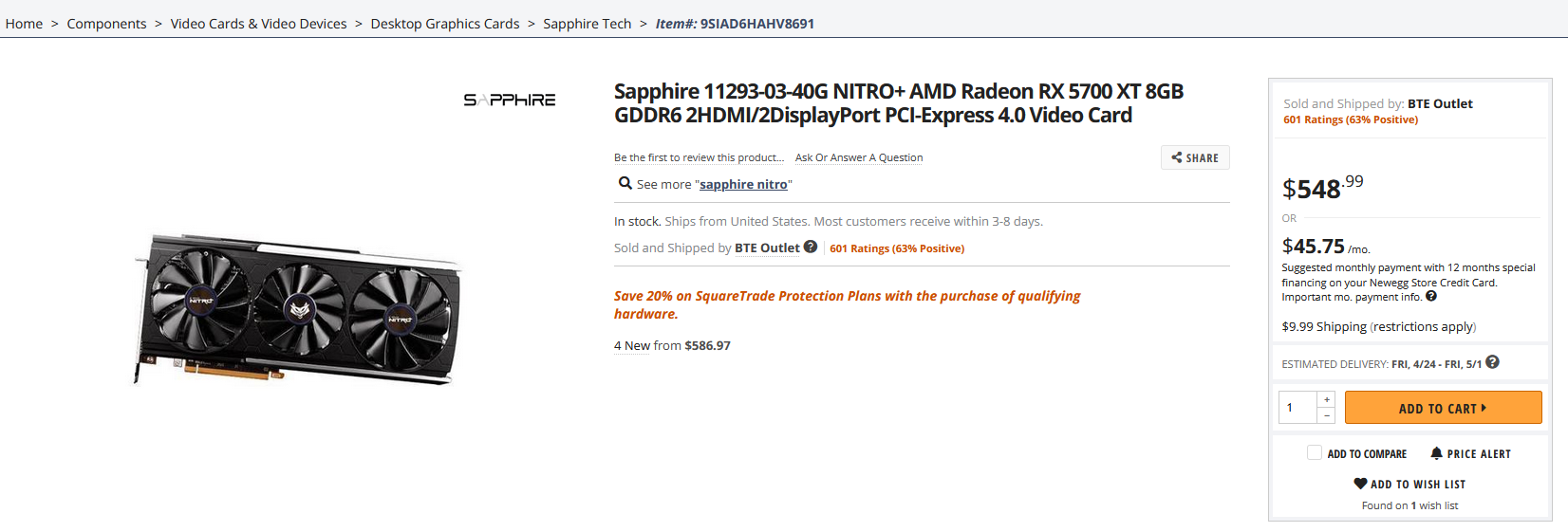

Or if you’re an AMD fan, you could save $150 on a Radeon 5700XT

So, do let us know in the comments below, what you would do with your $699

Before you do that, do check out our article on the iPhone SE, which starts at $399