Sono Motors, a German company whose electric vehicles charge themselves, is giving Tesla a run for its money in terms of cash preorders for its flagship vehicle and could go public soon.

Founded in 2016, Munich-based Sono Motor’s flagship Sion vehicle is encased with solar cells that allow it to self-charge, adding 112 kilometers of solar-generated range to its 54kWh battery each week.

Also equipped with a battery that can be charged off the electricity grid, the five-seat Sion is said to be able to travel 305 kilometers on a single charge — nearly 190 miles — with a planned base price of €25,500 ($30,000).

Still in the prototype stage, the Sion is expected to hit European markets in 2023, and has more than 13,000 preorders representing €278 million ($331 million) in sales on the books.

With the average deposit for a Sion being €3,000, Sono would have collected around $46 million in cash from reservations, which is nearly half the cash generated by Tesla TSLA, +0.14% for reservations on its Cybertruck.

The Cybertruck has more than 1 million preorders, according to a report from Electrek, with a low cash deposit of just $100. That figure is important, according to automotive analyst Matthias Schmidt, who publishes the European Electric Car Report.

“How much cash is being generated is often overlooked,” Schmidt told MarketWatch. “It says a lot about the confidence from the ‘community.’ ”

The Sion’s solar panels promise to deliver a charge worth three times the distance of those on the Hyundai Ioniq 5, which comes with an optional solar roof that the company claims can add 2,000 kilometers of range per year.

“Sono are claiming on average an added range of almost 6,000 kilometers per year, which adds to large savings from avoiding traditional recharging, which, let’s face it, isn’t going to be as cheap as many had us believe,” Schmidt said.

“It gives that reassurance to urban drivers in particular that they don’t necessarily have to search for public charging stations as often,” Schmidt added.

The analyst also said that the boost from solar energy provides a partial solution to the sustainability issues of relying solely on the electricity grid for battery power. In Germany — which accounts for nearly one-third of the European electric-vehicle market — more than half of electricity comes from fossil fuels, with a heavy reliance on coal, Schmidt noted.

New battery gives Sono’s PV-paneled car a range boost

The car features integrated solar cells across the hood, roof, doors and rear, which top up the onboard battery with the Sun’s energy whenever possible. The electric drive offers 150-kW peak power and 270 Nm (199 lb-ft) of torque, while top speed is listed as 140 km/h (87 mph).

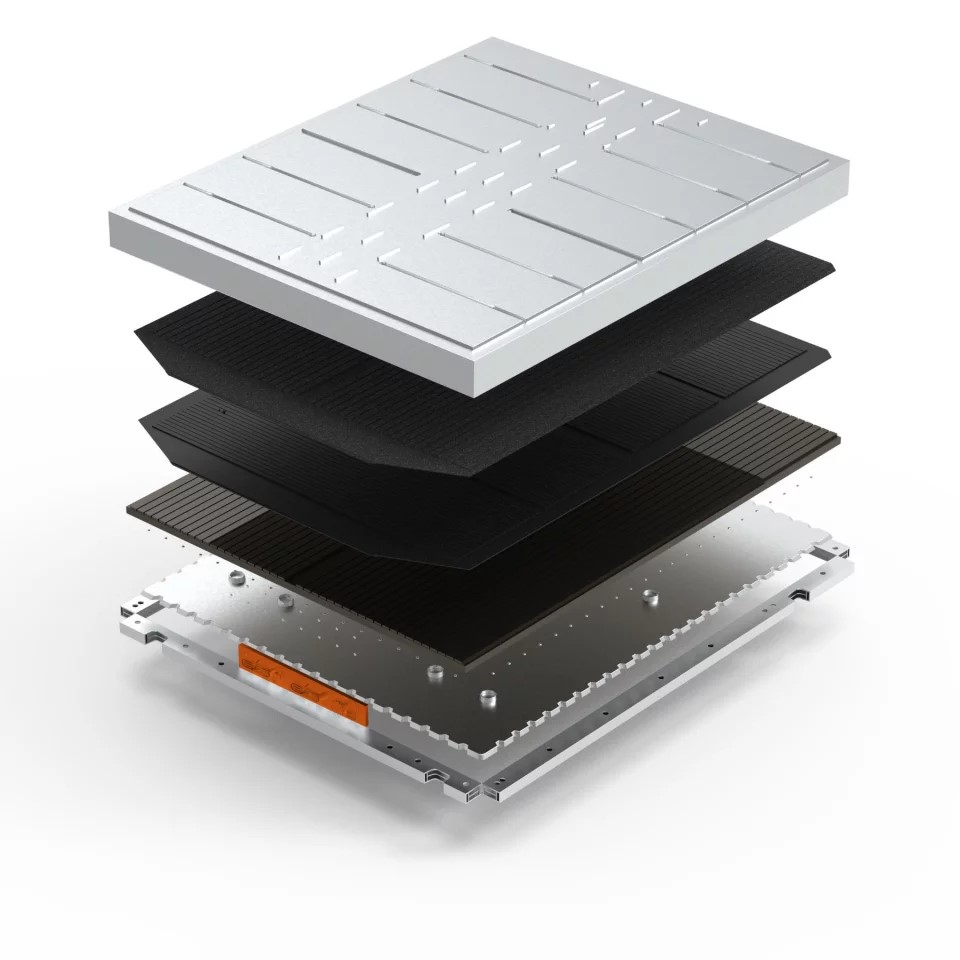

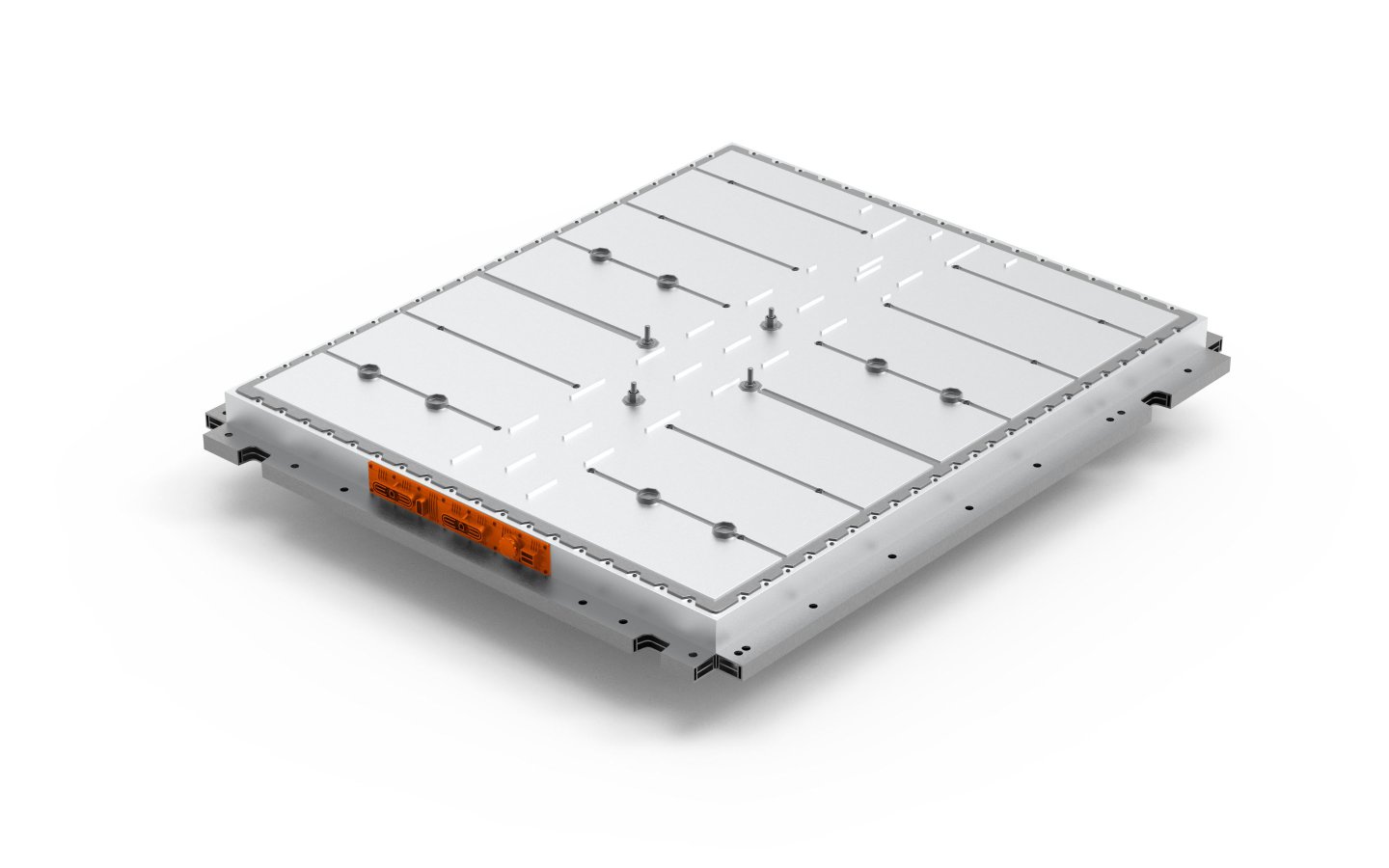

The solar cells are still expected to add a peak of 245 km (152 miles) of range per week in optimal conditions, but these will now feed energy into a newly designed 54-kWh lithium-iron phosphate battery, which, along with nickel and manganese, eschews cobalt, a traditional and troublesome battery component.

According to the company, this increases the range from 255 km (158 miles) to 305 km (190 miles), and also boosts the charging rate from 50 kW to 75 kW. Sono Motors says the battery will also remain safe and functional across 3,000 cycles, or enough to travel 900,000 km (560,00 miles).

“The growing EV market is generating enormous demand for longer-lasting, more sustainable batteries,” says Markus Volmer, Chief Technology Officer at Sono Motors. “This enhanced battery enables Sion drivers to extend the time between charges, whilst reducing the charging time itself. This effectively optimizes the Sion to deliver easy and affordable sustainable mobility for everyone.”

Sono Motors says it has now received more than 13,000 down payments for the Sion, which carries a full purchase price of €25,500 (about US$30,000). Production was originally planned to start next year, though that timeline is now unclear due to issues caused by the coronavirus pandemic.

Sono thinking of being listed in the U.S. stock market

Sono has also explored going public in the U.S. in a stock market listing that could value the company at more than $1 billion, Reuters reported in March. A float could take the form of a classic initial public offering or could come via a merger with a special-purpose acquisition company, or SPAC, also known as a blank-check entity, the report said.

For now, Sono’s greatest challenge is what Schmidt calls “the predatory nature” of original equipment manufacturers, or OEMs — the legacy automotime giants like Volkswagen VOW, +0.43% VWAGY, -0.10%, Daimler DAI, +0.32%, BMW BMW, +0.13% and Renault RNO, -0.28%.

While planned annual production of 40,000 vehicles would have made Sono a top-five electric-vehicle manufacturer in 2020, Schmidt sees the group as only achieving a minimal market share because of the threat the OEMs pose.

“They will likely be monitoring Sono’s market performance, and, if it is a relative success, they are likely to be barged out of the market by competitors waiting to pounce,” Schmidt said. “Other OEMs will only let them fly so high before swiping them out of the sky, which they failed to do with Tesla.”

But that doesn’t mean the company doesn’t have potential. One profitable avenue it could take, Schmidt said, is licensing its solar know-how to the auto giants. While this may kill its car business, it could make Sono a profitable supplier to the industry.