Mileage tracking will help you reduce auto expenses. Most small business entrepreneurs fail to take advantage of this tax deduction option because they lack clear records. But through TripLog you can easily keep track of business trips made, and this will make it easier for you to claim tax deductions. A few tips discussed below will also help you. If you reduce business costs, you will grow your business fast. One way through which you can do that is by reducing taxes. If you follow these tips, you will reduce auto deductions considerably.

Here are 4 Tips to Mileage tracking on a trip:

1. Update your diary

Every year, you should have a calendar of business events. This will help you to remember all the business trips and meetings that you have. It will be easier to identify business mileage deductible and file claims. Some drivers have paper logs where they record every trip made. This is tedious and usually has many errors. But if you are keen to update every trip detail on the paper log, then that is good. But there are other modern methods that you should adapt to track your mileage.

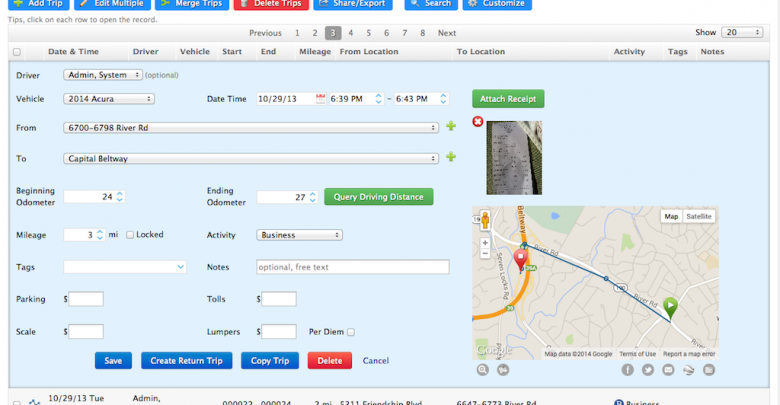

2. Mileage tracking apps

Advanced technology makes it easier for business entrepreneurs to keep track of their business trips. Through various mileage tracking apps, it is possible to capture all the trip details. The app has options on the type of trip, where you can record if it is a personal trip or business. The GPS tracking function will capture the destinations. You may also record the purpose of the trip and the duration. This information is important when determining the business mileage deductions.

3. Auto expenses calculations

To get the auto expenses deductibles, you may use the mileage or actual expenses. Some people calculate the auto expense using the two methods and opt to claim the one that has higher returns. In some cases, especially if you are leasing the business car, you may be limited to only use the standard mileage rate in your calculations. This is because the car maintenance expenses such as repairs, and insurance are catered for in the lease contract. But you may find out from the tax exemption authorities first before you calculate your deductibles.

4. Avoid common mistakes

Some of the common mistakes business entrepreneurs make include giving estimates of their auto expenses. Most of them round off the miles, and this shows that they don’t have the exact figures and may not qualify for mileage tax deductible. Some also repeat the mileage details of the previous year. This is not possible. Business strips differ from one year to another. You should also not claim that all mileage covered was on business trips. This may warrant an audit from the revenue collection authorities.

Mileage tracking is easy if you follow these tips. Remember to keep proper business records in case an audit is required to prove that the business miles you are presenting are genuine.