TSMC, which makes processors for Apple, Qualcomm, AMD, and numerous other big consumer tech companies, has warned that chip shortages could last through 2022. “We see the demand continue to be high,” TSMC CEO C. C. Wei said in comments reported by Bloomberg, “In 2023, I hope we can offer more capacity to support our customers. At that time, we’ll start to see the supply chain tightness release a little bit.” Taiwan Semiconductor Manufacturing Co. said on Thursday as the world’s biggest contract semiconductor maker unveiled bumper quarterly profits.

Wei’s comments mirror predictions made by Intel’s new CEO Pat Gelsinger earlier this week, who warned that it could take a few years to address the shortage, The Washington Post reported. “It just takes a couple of years to build capacity,” Gelsinger said. Likewise, Nvidia’s CFO Colette Kress recently said the graphics card manufacturer expects “demand to continue to exceed supply for much of this year.”

The warning, from the Taiwanese company at the heart of the global tech supply chain, suggests that the shortages that have rocked automakers and are spreading into consumer electronics will continue to reverberate.

But Wei also said TSMC does not rule out the possibility that massive overbooking could also lead to inventory corrections, despite robust structural demand for chips from tech “megatrends” such as 5G telecommunications and high-powered computing.

TSMC posted a near-record net profit in the first quarter of 2021, boosted by unprecedented chip demand. Net profit rose 19.4% on the year to 139.69 billion New Taiwan dollars ($4.91 billion) for the January-March period, while revenue rose 16.7% to NT$362.41 billion.

TSMC’s robust earnings come as major automakers and their governments press chip producers to increase production to help alleviate shortages that are affecting everything from cars to personal electronics and even the production of chipmaking tools themselves.

The global chip shortage has impacted everyone from automakers to games console manufacturers. Car manufacturers have had to scale back production, while anyone looking to upgrade their gaming setup has struggled to find stock of new graphics cards, CPUs, PS5s, and Xboxes.

The chip shortage has become so severe that the White House on Monday hosted a virtual summit which included the world’s top three chip producers, Intel, Samsung and TSMC, as well as multiple executives from carmakers, including Ford and General Motors, to discuss the issue.

The U.S. is also pressing global chipmakers to bring advanced chip manufacturing back to American soil in a move to regain leadership in semiconductor production, which is currently concentrated in Taiwan, South Korea and China.

Wei said his company had made automotive chip production a top priority since January, but a winter storm in Texas and the disruptions including earthquakes and a fire at a semiconductor factory in Japan have made the situation worse.

Wei said the automotive components shortage could be greatly reduced for TSMC customers by the next quarter. TSMC supplies most major automotive chip developers.

However, the CEO said that the car supply chain is long and complex and it will take about six months for chips to make it from production into car assembly.

The strong quarter follows a record year for TSMC, which reported annual revenue of NT$1.339 trillion and net income of NT$517.89 billion in 2020. TSMC’s best-ever quarterly profit was NT$142.76 billion in the fourth quarter of last year.

TSMC forecast that its revenue for the second quarter will beat market consensus to reach $12.9 billion to $13.2 billion, which would mean growth of nearly 26% from the same period last year at the midpoint. The company said its revenue could grow by 20% for the whole year of this year, exceeding the estimated 12% growth for the global semiconductor market, excluding memory chips.

TSMC said its high performance computing and automotive segments will grow more than 20%, while its smartphone and IoT platforms will grow by a similar level.

The Taiwanese chip giant — which supplies most of the world’s major chip developers, including Apple, Qualcomm and Nvidia — has confirmed that it will spend $100 billion through 2023 to build advanced chip production capacity and expand existing plants to address “the structural and fundamental increase” in demand. TSMC CEO C.C. Wei told clients in a letter that the company will cancel its usual wafer price reductions from the end of 2021 as it ramps up its capital expenditure.

The CEO added that TSMC’s advanced chip plant in Arizona will start construction as planned and start production in 2024. He indicated that the company has acquired land in the U.S. “Further expansion is possible and it will serve customers globally,” he said.

In addition to juggling extremely high demand, TSMC is also facing water shortages in multiple cities in Taiwan where it operates major chip facilities. The island is suffering its most serious drought in 56 years, which bodes ill for an industry that requires massive amounts of extremely pure water.

To make matters worse, TSMC was struck by a temporary power outage on Wednesday when an underground power line was accidentally cut during construction work at a science park in the southern city of Tainan.

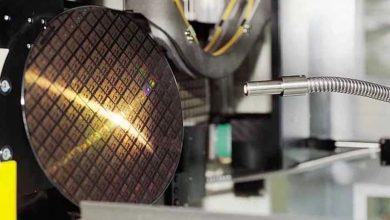

TSMC’s chip fabrication plant in the province’s Tainan sector experienced a power outage on Wednesday 14th April. This facility is responsible for fabricating semiconductors on the 12nm and higher process nodes, with its output primarily used to supply chips destined for automotive uses. It comes as the global automotive industry is dealing with a semiconductor supply crisis, and initial, unofficial estimates suggest that the damage could amount to millions of NT$.

Due to the outage, Taiwanese industry sources expect that the damage to TSMC’s output can reach millions of NT$. While the company is yet to officially provide an update about the damage. As TSMC evaluates the situation, up to 30,000 wafers are expected to be impacted due to the power breakdown.

Wei said the water supply in Taiwan is indeed tight but his company has long prepared for such a risk. “We are continuing our collaborative efforts with the government as well as with the private sector. … We do not expect to see any material impact on our operations,” he said.

Mark Li, an analyst with Sanford C. Bernstein, told Nikkei Asia that the chip demand boom could last at least until the end of September and that overall capacity is extremely full. “The impact of the power outage may not be significant,” Li said. “It’s really an unprecedented scene of the robust chip demand and shortage that the semiconductor industry hasn’t experienced in decades. … If there are no unexpected disruptions, TSMC’s revenue this year could likely grow more than 20% for 2021.”